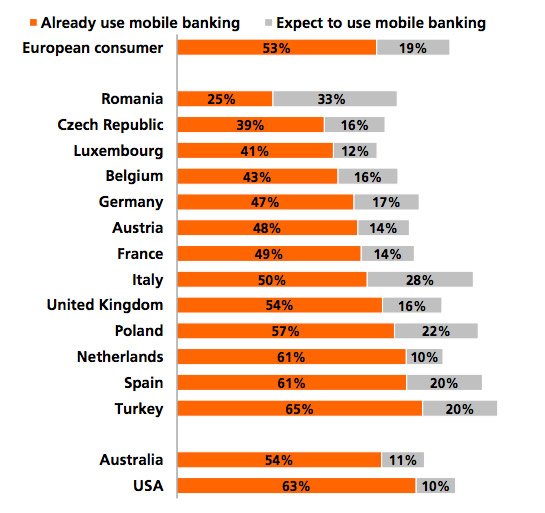

In Europe, Turkey is the country with the most customers using mobile banking. Here, 65% of those surveyed said that they do their banking on the go; a further 20% plan to do so next year.

Spain follows in second place, with 61% currently using mobile banking and, again, 20% planning to do so next year, while The Netherlands comes in third place, with 61% and 10%, respectively. These are the figures reported by the direct bank ING-DiBa, which regularly surveys bank customers around world for their ING International Survey. Mobile banking – that is, the conducting of banking transactions on smartphones and other mobile devices – has long been a major topic in the survey. According to the survey, the European average for mobile banking customers is 53%, with a further 19% of customers planning to do their online banking on mobile devices next year. To compare: In the US, this figure is 63% and in Australia, 54%. If, however, the findings of the survey are combined with the degree of Internet penetration in individual countries, The Netherlands come out top with 58%, followed by Great Britain with 49% and Spain with 45%. Australia then comes in with 44% mobile banking users and the US with 50%.

For the survey, the opinion research institute Ipsos surveyed a total of 14,829 people aged 18 and above online in Belgium, Germany, France, Great Britain, Italy, Luxembourg, The Netherlands, Austria, Poland, Romania, Spain, Turkey, the Czech Republic, Australia and the US. The complete survey can be downloaded as a free PDF from ING-DiBa’s website. (Source: ING-DiBa/rf)